BUDGET 2014-15: ‘Medicine to Indian Economy’ #ModiNomics

written by: Khyati Srivastava (khyati.khush@gmail.com)

“Its not NDA vs UPA at all! Its all about reviving the Indian Economy!” says

the present Indian Finance Minister, Mr Jaithley, the Mr Dependable of

ModiNomics.

India has recently constituted its

16th Lok Sabha after a strong wave that incited the people to bring

about a change the nation needs and have a government that can bring ‘achhe din’! Hence on 26th

May’2014, under the leadership of Shri Narendra Modi BJP led NDA came to power

with clear majority and ending the era of (compromising) coalition politics. Eventually the people were direly looking

towards the General Budget 2014-15 presented by the new government to welcome

the advent of promised ‘good-days’. On

10th July’2014, the 45-days old novice government presented its

first General Budget.

In his around 3-hours Budget

speech, Shri Jaithley read 253-paras of general budget 2014-15, covering almost

all sectors of the Indian Economy. Opponents review the budget as a

carry-forward of the UPA budget only in new attire, and deceiving the hopes of

the common-man on the promise of good-days. However, critics comment on it as a

pathway towards those good-days. Most of the economist praise the Budget as one

that the Nation needed the most to revive its unhealthy state. Let us

understand on what basis are such conclusions derived.

The status of Indian Economy is not

so well-off. To put in the words of the government there is an ‘unhealthy

legacy’ that they have received. Presently, we have a high fiscal deficit of

4.5% of GDP, high inflation rates, sluggish economic growth rate, prominently

static (low) industrial growth rate and huge unemployment.

In his words, "We have no option but to take some bold steps to spurt

economy; these are only the first steps and are directional."

Therefore, with all these challenges in pocket, the Budget was put

forward with a vision of ‘Sab ka Saath,

Sabka Vikas’, as described by the Finance

Minister.

Though, he valiantly accepted that

there is no quick remedy to overcome the disease, but a slow sanjeevni booti

to be injected. To quote him, "The fiscal deficit target of 4.1 percent put out by my

predecessor is indeed daunting. But I have decided to accept the target."

Hence, he declared a low target of 4.1%

of GDP as Fiscal Deficit for 2014-15. But a ambitiously targeted it to be 3.6%

of GDP for 2015-16. He aims to achieve a growth rate of 7-8% in coming 3-4years.

a. Gifts for Aam

Aadmi :

The biggest

that the common people of India were looking for in this budget was

‘tax-relief’, and thankfully they have it right there.

-

Limits for exemption in tax has been increased

by Rs50000 for Income Tax payers both below/above 60years. Plus, exemption

under IT-Act u/s 80c has also been increased by Rs50000. This has been done

with an objective to boost the culture of savings in people. Now, a common

man earning Rs3.5lac p.a (including Rs1.5lac savings) is outside the purview of

taxation!

Moreover, at Macro-level, India is facing Inflation as

well as sluggish Industrial Growth. The market is losing investors’ trust. In

this case, capital investment chain needs to be boosted. It will happen only

when the domestic savings shot-up. Hence, the 80c exemption, which was kept

constant for long, shall ignite the savings level.

-

The budget has proposed to increase the exemption

limit for housing loan rebate by Rs50000. Even the PPF limit has

been increased to Rs1.5lac.

-

The Finance Minister declared his approach over

(controversial) retrospective tax issue. He is in no mood to give them a way.

However, he has put forward to set up a committee to examine the pending cases

under this issue.

-

The FM’s bag proved to be a healthy shock for

tobacco-people. Duties on cigarettes have been raised from 11% to 72%.

Similarly, duties on other tobacco products have also been increased. This

will surely increase their COP and hence their price in coming days. Even

additional duties are levied on aerated drinks with added sugar. (Perhaps,

reducing the ‘tufani’ consumption!)

b. Revival of

Economy :

When India

is presently world’s youngest nation, it has great potential. Having median age

of approx 29yrs, it has more advantage of encashing the world GDP share

compared to other developing nations. But alas! The clumsy economic picture

will not give way. India is in dire need to revitalize its capital market,

create more employment opportunities, specifically in the manufacturing sector

that will yield more long-term benefits. Further, in this process the country

needs more investment and advanced infrastructure. The Union Budget 2014-15

has hence paved way for this start.

-

Mr Minister agrees with the former Finance Minister’s approach of emphasizing, re-emphasizing and

over-emphasizing Fiscal prudence. To

put in Mr Jaithley’s words, “Fiscal prudence to me is of paramount

importance because of considerations of inter-generational equity.”

-

Thus, he proposes decreased

expenditure (culture by former govt) to order to check the CAD. Though the decrease has not been kept too low to

hamper the growth process. Rather focus

is on more revenue creation. The Budget estimates that total expenditure will be

17.95 trillion rupees in 2014-15.

-

Henceforth, the Revenue deficit is anticipated to be 2.9 percent of

GDP in 2014-15 and Capital receipts seen at 739.5 billion rupees in 2014-15.

-

For instance, the Interim Budget had paved way to expand the

auto-sector by allowing rebate for 3months, which the Finance Minister has

extended for 6 more months. The sector started showing positive outcomes since

June’14. Hence, Mr Jaithley extended it and proposed more such expansions in other sectors to strengthen the Indian

Industrial arena.

-

The electronics,

durables and manufacturing units have been promoted in the budget

proposals. As a result soon we will have cheaper LCDs/LEDs (19inches) in the

market. This is done in order to expand the economic activity base in

India, exploit more potential and pool-in more investment. Thereby creating

more employment opportunities and growth.

-

Mr Jaithley has opened gateways for Investment in India. The

Budget raises limit on foreign direct investment in defence sector

from 26 percent to 49 percent, and raises FDI limit in insurance sector from 26

percent to 49 percent. Disinvestment

target has been fixed at Rs58425cr. Moreover, PSUs shareholdings have been

extended to public on direct basis.

-

Valiant decision to give PSU Banks autonomy. Extending them freedom to lend long term infrastructural loans with

minimum regulatory pre-emption (CLR,SLR,PLR). This is a courageous step to

have speedy investment for infrastructure development. Projects for metro (in

Lucknow & Ahmedabad) has been encouraged. Plus many proposals to strengthen

the urban as well as rural infrastructure have been taken. Warehousing infrastructure has

also been focused upon.

-

National Industrial Corridor Authority (HO-Pune) shall be set up to coordinate the

development of the industrial corridors.

-

Several clusters to be made on the basis of

local skills to promote textiles in local areas. (eg: Chikenkari of Lucknow, Handlooms of

Varanasi)

c. Empowernment :

The Budget

2014-15 under NDA regime however denied continuing with the populist schemes like the former

government, and resort to rational policies. Though Mr Jaithley gave

affirmation to continue with the populist schemes of the former government,

MGNREGA and food security provisions (Rs115000cr) but directed to make it more productive and asset-linked. So that

they are not mere khairat rather

create assets for the economy. Several more empowerment projects have been

proposed:

-

More funds for SSA and RMSA. Pandit Madan Mohan Malviya New Teachers Training Programme launched.

Jai Prakash Narayan National Centre for

Excellence in Humanities to be set up in Madhya Pradesh.

-

5-new IIMs in HP,

Bihar, Odisha and Rajasthan, 5-more IITs

in J&K, Chhatisgarh, Goa, Andra and Kerala have been proposed. Even 4-new AIIMS in Andra, WB, Maharashtra

(Vidarbha) and UP (Poorvanchal) are proposed.

-

Idea to develop

100 smart cities (Rs7060cr set aside) and IT equipped villages under National Rural Internet & Technological

Mission has been mentioned.

-

Shyama Pd

Mukherjee Rurban Mission to replicate the Gujrat model of Rural/Urban

development and skill development shall be replicated Nationwide through PPP

mode. Develop Crisis centres for Women

safety in large cities.

-

Young

Leaders Program with Rs100cr allocation shall be started to promote

leadership skills in youth. Moreover, Employment

exchanges shall provide counseling facility as well from now. Program named

Skill India shall be launched to

promote employability and

entrepreneurship skills. (Specialised Skills for cobbler, carpenters,

blacksmiths, weavers, etc) Moreover convergence

of several such running schemes is proposed. Madarasa

modernization(Rs100cr).

-

PM Krishi

Sinchaiyee Yojna is proposed with Rs1000cr set aside, to provide

irrigation assistance to farmers. Kisan

Vikas Patras to be started again to boost farmers saving. National Adaptation Fund with Rs100cr

to absorb climate change risks of farmers. Additional Rs5000cr above Interim

Budget amount given to Rural

Infrastructure Development Fund (which helps in creation of Infrastructure

in agriculture & Rural sector). Rs5000cr for Warehouse Infrastructure Fund has been allocated.

-

These measures are hopeful to revive the Indian farmer from the vicious circle of

backwardness by resolving his market problems and easy access to credit.

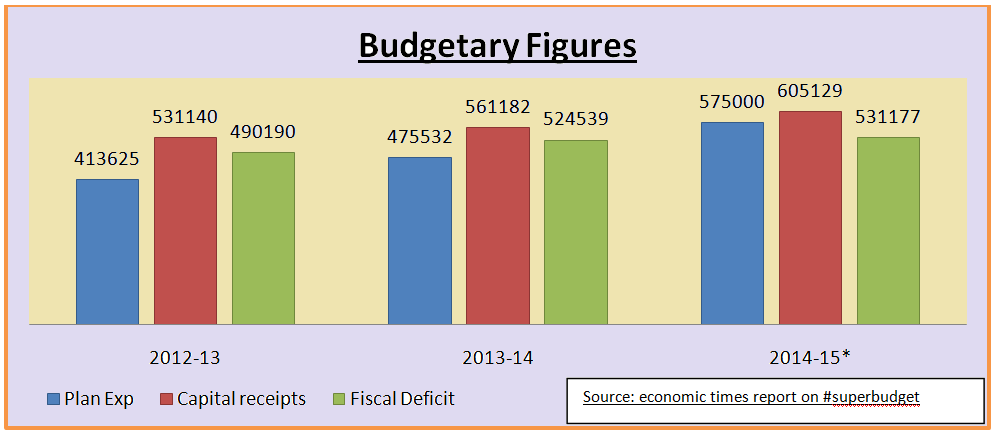

In the end, let us compare the major statistics of 2014-15

Budget with those of recent past.

Perhaps, the criticism on amount allocation

on several projects and schemes is also valid. “It’s a 100cr budget!” As remarked by Raga. Still there is no need

to lose hope on this, and we must depend on Mr Jaithley’s words, “these nominal funds are set aside to just

put-in action plans. It would be dubious to release more in just 45-days

planning.” Overall, the Nation can be hopeful by Mr Jaithley’s commitment

and assurance, and remark it as less of mere Modinomics.

Mr Jaithley has accepted the target of 4.1% of GDP as Fiscal

Deficit for 2014-15. Also has ambitiously targeted it to be 3.6% of GDP for

2015-16. He aims to achieve a growth rate of 7-8% in coming 3-4years. Yes!

Ofcourse, a lot has been carried forward from UPA-agenda. But there is even

more that has been innovated. The indecisiveness of the coalition politics in

India under UPA had left several areas unresolved, where Mr Jaithley got

advantage over. The simple reforms in

tax-slab and savings will benefit both households as well as economy as a

whole, for it stimulates expenditure as well as savings. It promises more

capital formation, investment and accelerated multi sector growth.

Comments

Post a Comment